All Categories

Featured

Table of Contents

For lots of people, the most significant problem with the boundless banking concept is that initial hit to very early liquidity caused by the costs. Although this disadvantage of boundless banking can be lessened substantially with appropriate policy layout, the initial years will always be the most awful years with any kind of Whole Life plan.

That stated, there are specific boundless financial life insurance policy plans made mainly for high very early money worth (HECV) of over 90% in the initial year. The long-term performance will typically substantially lag the best-performing Infinite Financial life insurance plans. Having access to that additional four figures in the initial few years may come with the price of 6-figures later on.

You really obtain some significant long-lasting advantages that help you recoup these early expenses and afterwards some. We locate that this hindered very early liquidity issue with limitless financial is a lot more mental than anything else as soon as completely checked out. If they absolutely needed every penny of the money missing out on from their infinite banking life insurance plan in the initial couple of years.

Tag: infinite financial concept In this episode, I speak about finances with Mary Jo Irmen that educates the Infinite Banking Idea. This subject may be controversial, yet I desire to get diverse sights on the show and discover regarding various strategies for ranch monetary management. Several of you may concur and others will not, but Mary Jo brings a really... With the rise of TikTok as an information-sharing platform, monetary advice and techniques have actually located a novel way of spreading. One such method that has been making the rounds is the infinite banking idea, or IBC for brief, gathering recommendations from stars like rapper Waka Flocka Flame. While the method is presently preferred, its origins trace back to the 1980s when economic expert Nelson Nash presented it to the globe.

Within these policies, the money worth grows based on a price established by the insurance firm. As soon as a significant money worth gathers, insurance holders can acquire a money value loan. These lendings differ from traditional ones, with life insurance functioning as security, indicating one might lose their coverage if borrowing excessively without appropriate cash money worth to sustain the insurance expenses.

And while the attraction of these plans appears, there are innate constraints and threats, demanding diligent cash worth tracking. The strategy's authenticity isn't black and white. For high-net-worth people or local business owner, specifically those using methods like company-owned life insurance policy (COLI), the advantages of tax breaks and substance growth might be appealing.

Infinite Banking Real Estate

The allure of boundless financial doesn't negate its obstacles: Expense: The foundational demand, a permanent life insurance policy policy, is costlier than its term counterparts. Qualification: Not everyone gets approved for entire life insurance due to extensive underwriting procedures that can exclude those with details wellness or way of life problems. Intricacy and risk: The elaborate nature of IBC, combined with its dangers, might prevent lots of, specifically when easier and less high-risk choices are offered.

Alloting around 10% of your regular monthly earnings to the plan is just not feasible for a lot of individuals. Component of what you read below is simply a reiteration of what has actually already been claimed over.

So before you obtain into a situation you're not gotten ready for, understand the adhering to initially: Although the principle is typically offered therefore, you're not actually taking a funding from on your own. If that were the case, you would not need to settle it. Rather, you're borrowing from the insurance provider and have to settle it with rate of interest.

Some social media articles advise making use of cash money worth from entire life insurance coverage to pay down credit card financial debt. When you pay back the loan, a section of that interest goes to the insurance policy business.

For the initial several years, you'll be paying off the commission. This makes it incredibly hard for your policy to collect worth throughout this time. Unless you can afford to pay a few to several hundred bucks for the next decade or even more, IBC won't function for you.

Infinite Banking 101

Not everybody needs to depend only on themselves for economic safety. If you need life insurance policy, below are some useful suggestions to take into consideration: Think about term life insurance policy. These policies give protection throughout years with substantial economic commitments, like mortgages, trainee car loans, or when caring for children. Make certain to go shopping about for the very best rate.

Copyright (c) 2023, Intercom, Inc. () with Scheduled Font Call "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Reserved Typeface Call "Montserrat".

Infinite Banking System

As a CPA concentrating on realty investing, I have actually combed shoulders with the "Infinite Banking Idea" (IBC) more times than I can count. I have actually also talked to professionals on the topic. The major draw, in addition to the noticeable life insurance policy advantages, was constantly the concept of developing cash money worth within an irreversible life insurance policy plan and borrowing versus it.

Certain, that makes feeling. Truthfully, I constantly believed that cash would be better invested straight on investments instead than channeling it through a life insurance plan Until I uncovered just how IBC can be integrated with an Irrevocable Life Insurance Trust (ILIT) to create generational wide range. Let's start with the basics.

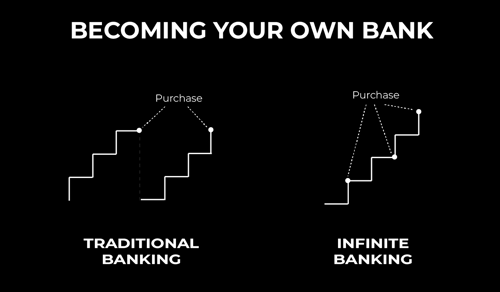

How Infinite Banking Works

When you obtain against your plan's cash value, there's no collection payment routine, offering you the flexibility to take care of the funding on your terms. The money value proceeds to grow based on the plan's warranties and returns. This setup permits you to access liquidity without disrupting the long-term development of your plan, provided that the lending and rate of interest are handled intelligently.

The process proceeds with future generations. As grandchildren are born and expand up, the ILIT can buy life insurance plans on their lives. The count on then collects numerous plans, each with expanding cash values and survivor benefit. With these policies in position, the ILIT effectively comes to be a "Family members Financial institution." Relative can take financings from the ILIT, making use of the money value of the policies to fund financial investments, start businesses, or cover major expenditures.

An essential element of managing this Family members Bank is the use of the HEMS requirement, which means "Health, Education, Maintenance, or Support." This standard is usually consisted of in trust arrangements to guide the trustee on just how they can distribute funds to recipients. By adhering to the HEMS criterion, the trust fund ensures that circulations are produced necessary needs and long-term assistance, securing the depend on's possessions while still offering member of the family.

Boosted Adaptability: Unlike rigid small business loan, you manage the settlement terms when borrowing from your own policy. This permits you to framework repayments in such a way that aligns with your business capital. banking on yourself. Enhanced Cash Flow: By financing overhead via policy financings, you can potentially free up money that would otherwise be bound in typical car loan repayments or tools leases

He has the same tools, however has additionally developed extra cash value in his policy and obtained tax obligation advantages. Plus, he now has $50,000 offered in his policy to utilize for future opportunities or expenses., it's crucial to see it as more than just life insurance policy.

Td Bank Visa Infinite

It's regarding producing a flexible funding system that offers you control and supplies numerous advantages. When used tactically, it can match various other investments and company techniques. If you're fascinated by the possibility of the Infinite Financial Concept for your service, here are some actions to think about: Inform Yourself: Dive deeper right into the principle via respectable books, workshops, or assessments with knowledgeable specialists.

Latest Posts

Infinite Banking Insurance

Be Your Own Bank With The Infinite Banking Concept

Life Insurance Banking